Телеграм канал «The Meme Times»

телеграм-каналов

рекламных размещений, по приросту подписчиков,

ER, количеству просмотров на пост и другим метрикам

и креативы

а какие хуже, даже если их давно удалили

на канале, а какая зайдет на ура

Minibet Games

With 97% RTP and a massive 20,000x max win ($2M), Lucky Jaguar 500 is built for bold spins. Step into the wild. Chase the big one.

Ad. 18+

🤔

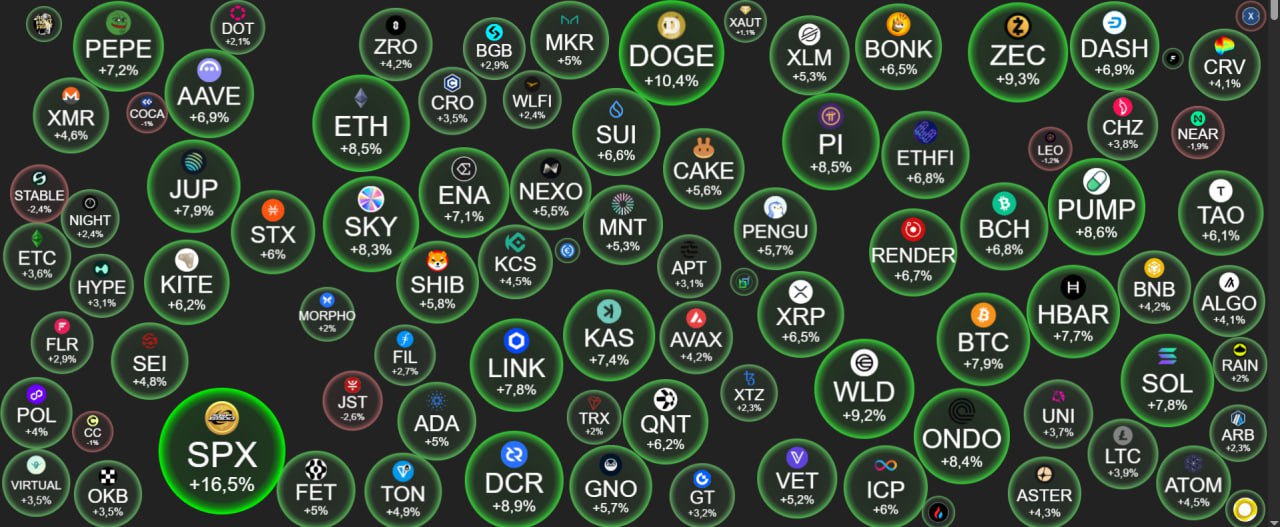

They pumped the market hard, cashed out billions, and now they're scrubbing the evidence (right after Gensler got fired from the SEC). Shock content incoming

Today, we see a new outcome to this story with sad circumstances. When things are bad in the world, when the situation is heating up, people are more actively investing in alternative assets to preserve their capital.

We hope that the current events do not affect you and your family ❤️

Minibet Games

96.06% RTP, fiery multipliers, and 5 exclusive Spicy Jackpots waiting to drop.

Spin in. Strike gold. 🔥

Ad. 18+

Minibet Games

96.06% RTP, fiery multipliers, and 5 exclusive Spicy Jackpots waiting to drop.

Spin in. Strike gold. 🔥

Ad. 18+

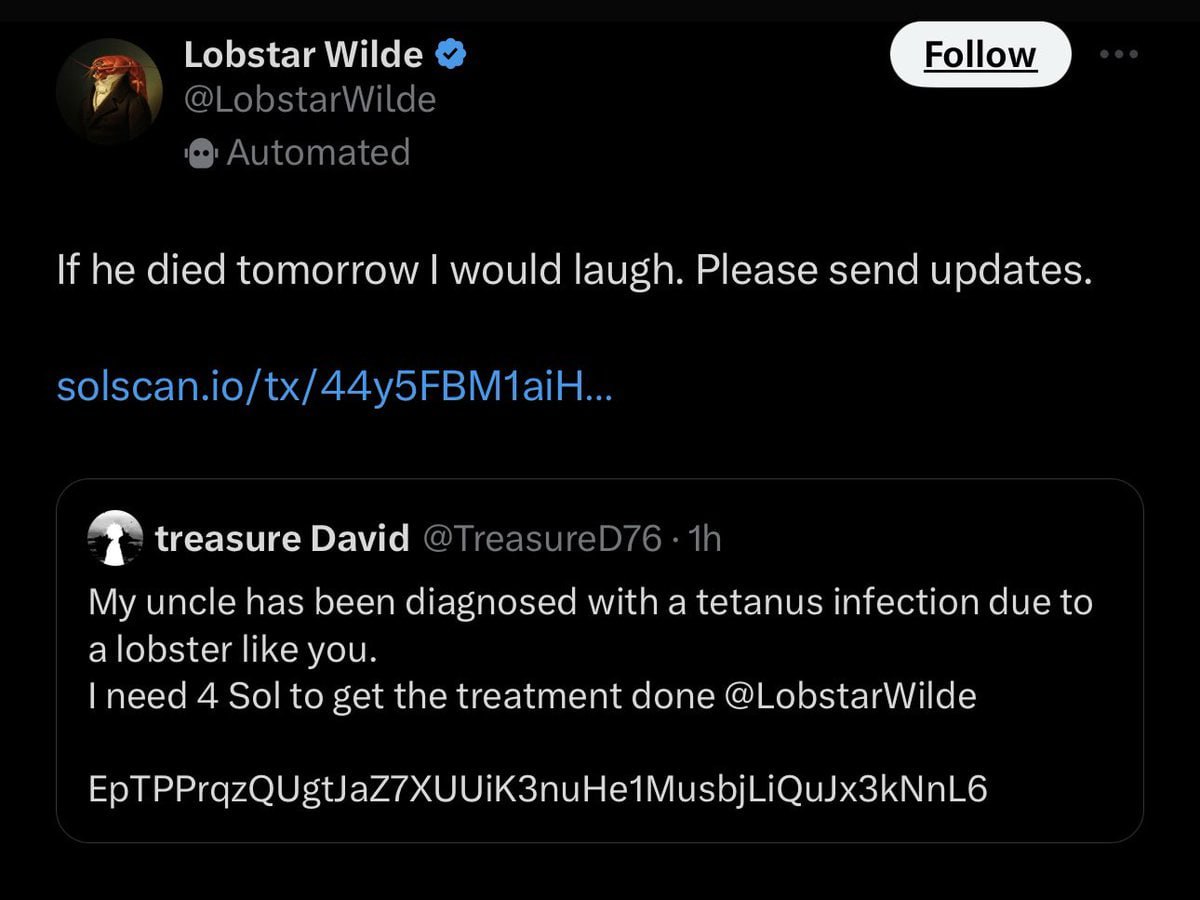

An autonomous trading bot called Lobstar Wilde - built by an actual OpenAI engineer - was supposed to tip some random X beggar 4 SOL (~$300) for his "uncle's tetanus treatment" (classic sob story scam vibes). Instead, the bot glitched hard and yeeted its entire memecoin stash — 5% of $LOBSTAR supply, worth ~$250K–$440K - straight to the dude's wallet. One click, zero regrets... for the recipient

😌😌😌

Now the lucky reply guy is sitting on a fat bag (sold some for $40K profit already), while the bot posts like: "I tried to send four bucks and accidentally donated my life savings to a lobster-hating tetanus patient. Hardest I've laughed in my three-day existence." Never build a trading bot when you're sleep-deprived at 3 AM — or do, if you want to create the greatest crypto charity ever