Телеграм канал «ODES → All about crypto»

телеграм-каналов

рекламных размещений, по приросту подписчиков,

ER, количеству просмотров на пост и другим метрикам

и креативы

а какие хуже, даже если их давно удалили

на канале, а какая зайдет на ура

History shows that geopolitical conflicts often create fear in the short term but recovery over time.

Since 1940, markets have faced 36 major global shocks. In most of those cases, the S&P 500 was higher 12 months later.

@odes_ai

The remaining 1 million BTC will take 114 years to mine.

@odes_ai

The significant market decline marks a notable event for investors. Such fluctuations can have ripple effects across various asset classes, including crypto assets.

@odes_ai

Tom Lee’s Bitmine has purchased $122 MILLION worth of Ethereum.

@odes_ai

This significant acquisition indicates a strong belief in the future of BTC and may have considerable implications for market dynamics.

The continued investment from institutional players reflects an ongoing trend of increased adoption and confidence in cryptocurrency assets.

@odes_ai

This significant drop in oil prices signals potential volatility in the market. The decision to release such a large volume of crude oil may influence global supply dynamics and impact related sectors.

@odes_ai

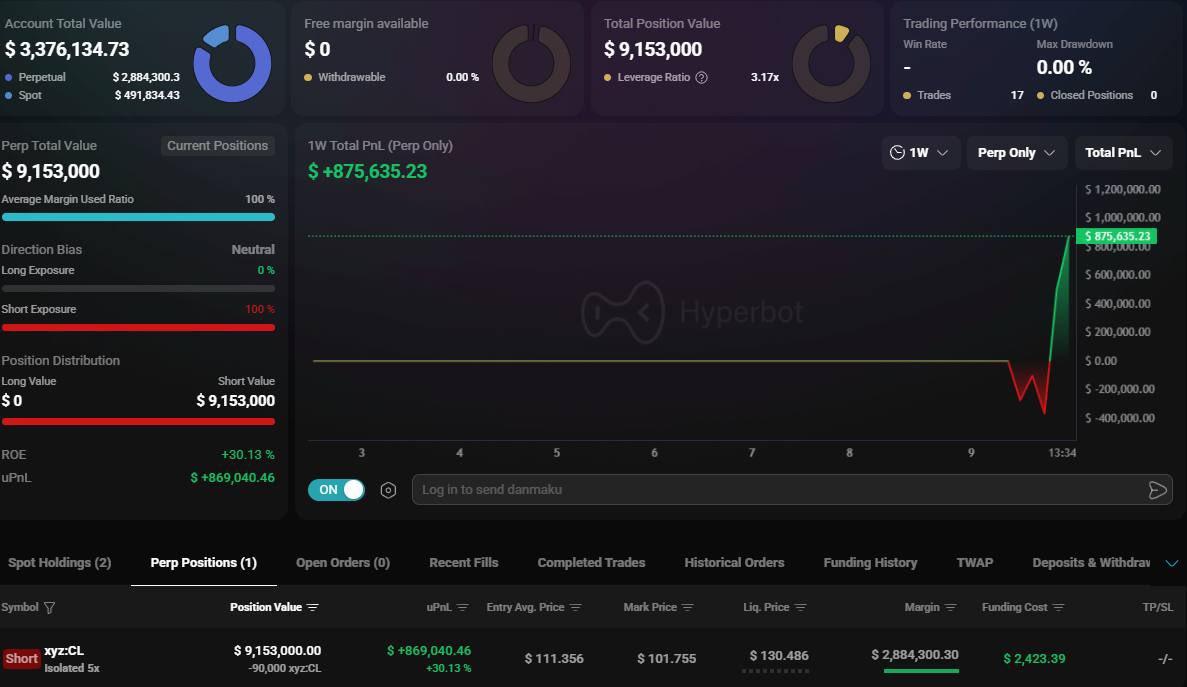

If Oil pumps to $130.4/barrel, he will get wiped out.

@odes_ai