Телеграм канал «Forex Automation With Andrei Kreicbergs»

🔥MY SOCIALS 👇

Insta:Instagram.com/andreikreic

Facebook: https://www.facebook.com/andrei.kreicberg

Telegram:@andreikreic

телеграм-каналов

рекламных размещений, по приросту подписчиков,

ER, количеству просмотров на пост и другим метрикам

и креативы

а какие хуже, даже если их давно удалили

на канале, а какая зайдет на ура

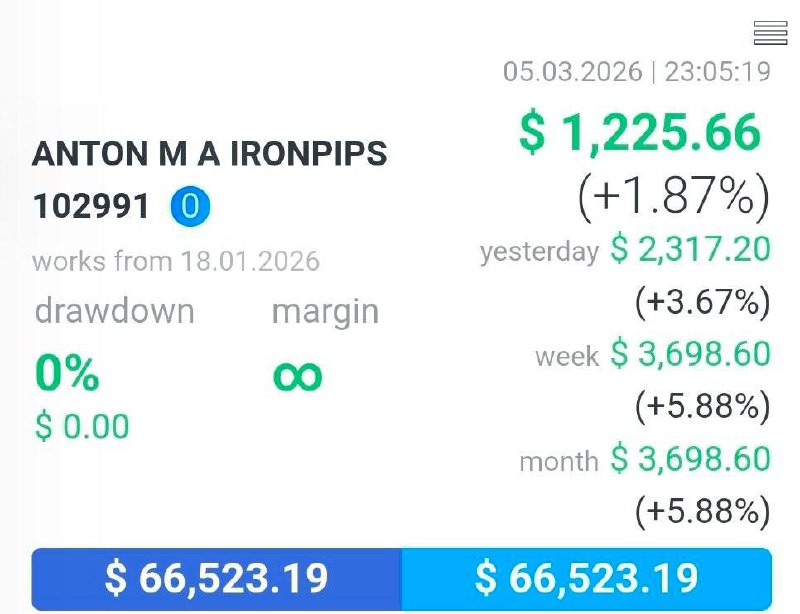

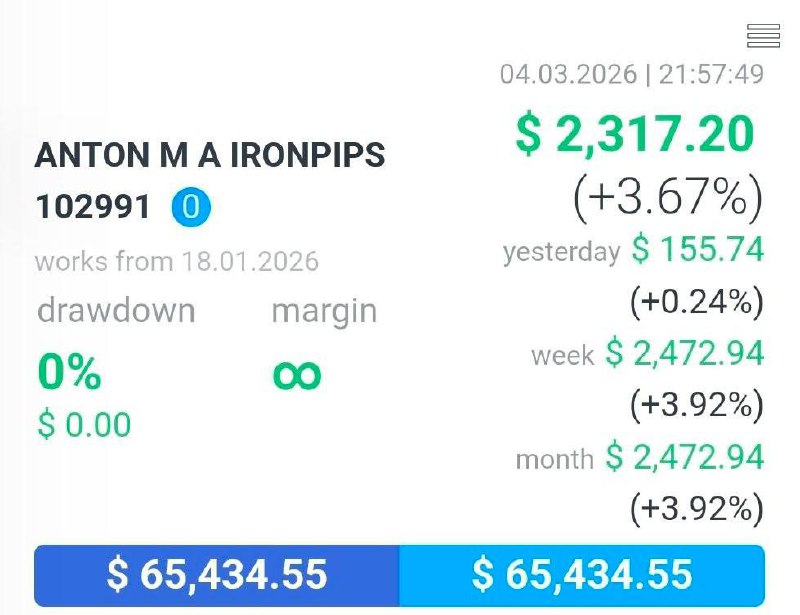

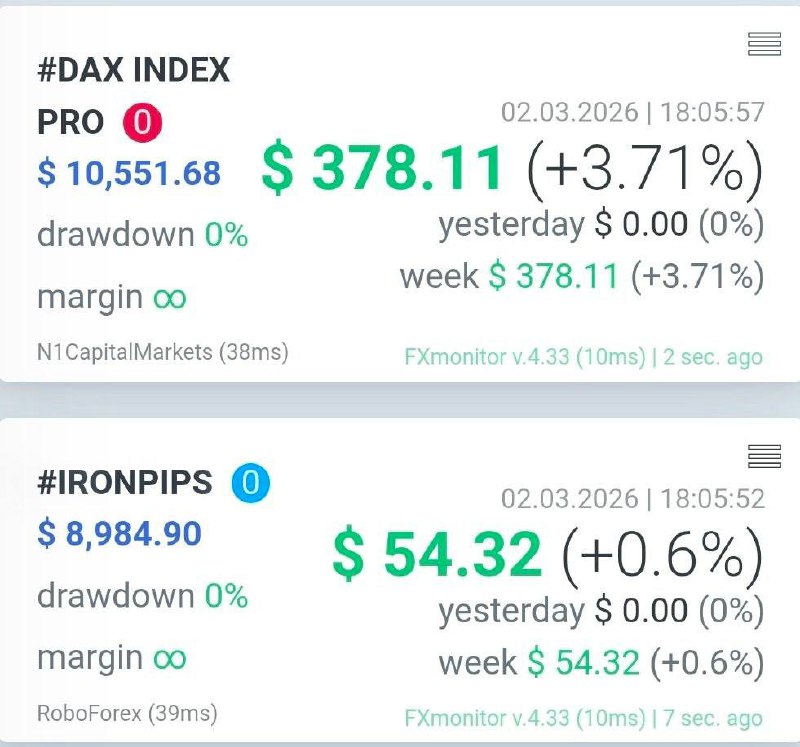

Crazy system…also attached our clients Anton’s results

This is from the other day, one of our clients pulled in $2,000 clean in a day 🤓

He is HEAVILY INVESTED with us as you can tell

💵if you want to get started with any of our trading systems simply drop our admin 👉 @kalnrozes a message saying ‘FOREX’ and we give you a start.

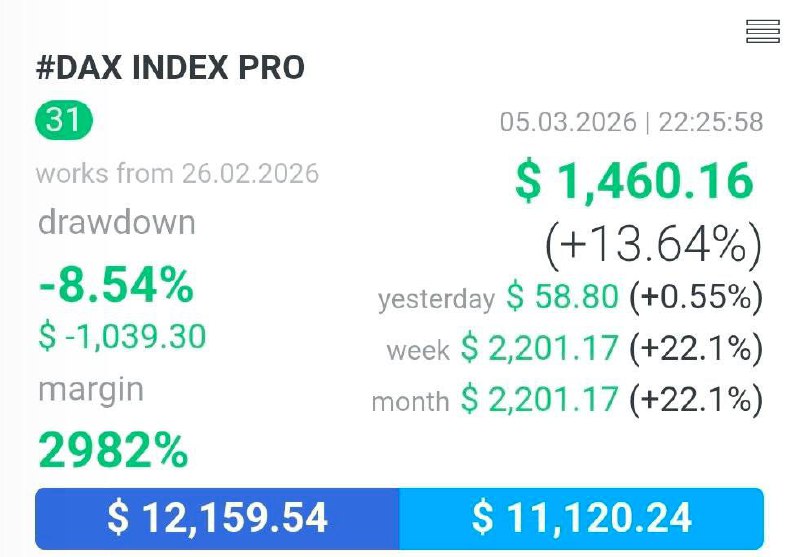

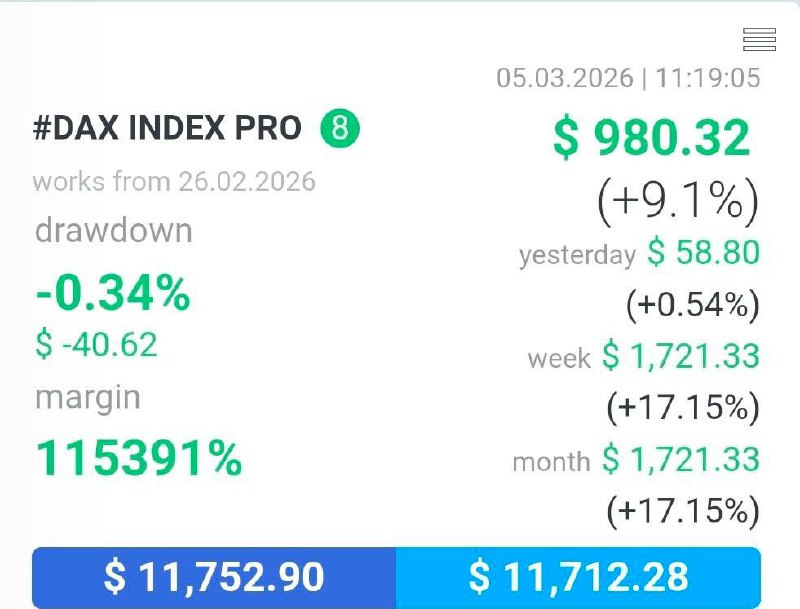

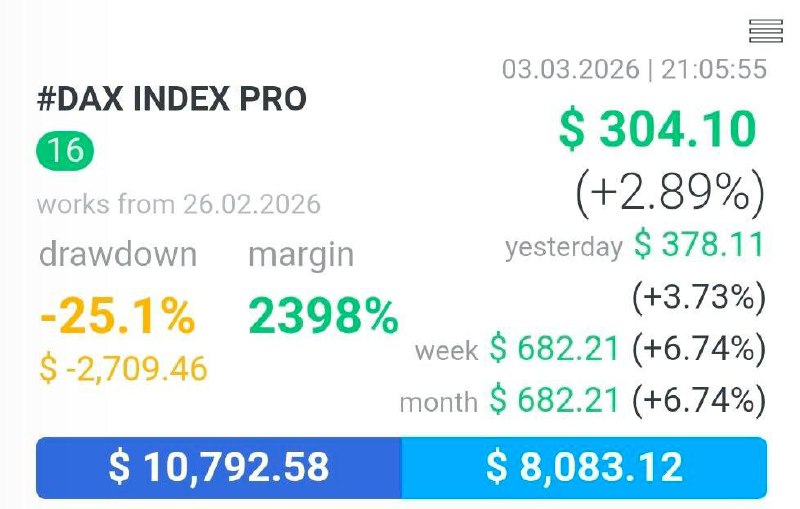

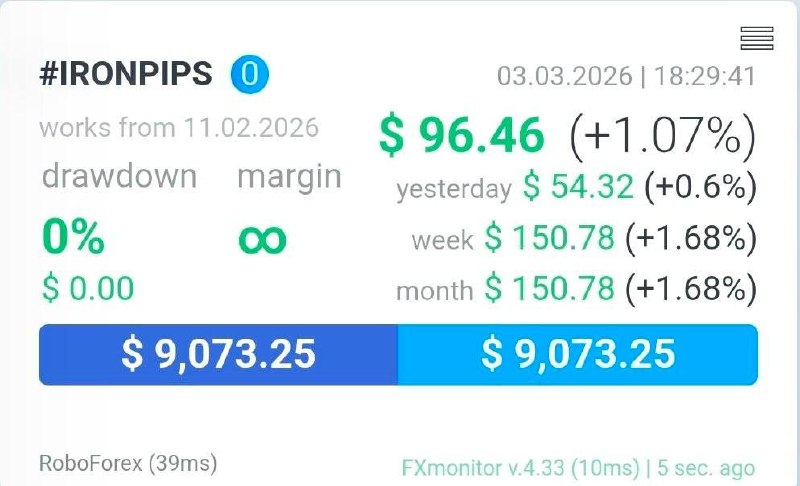

We got 2 working systems in place now, IronPips+ DAX

Our Dax Strategy, did you sign up to our forex automation program?

All info is above to get in touch and get started, another new project coming out soon…

We are expanding the capabilities of our premium IronPips strategy. Choose the return format and risk level that best fits your financial strategy.

All three systems utilize our expert manual trading: no grids, no martingale, only precise entries and fixed stop-losses.

🛡 1. Conservative Version

Designed for those who prioritize capital preservation.

Minimum Deposit: $1,000

Target Return: Up to 10% per month

Risk Management: Low account load (0.5–1% per trade).

⚖️ 2. Balanced Version

The perfect balance between stability and growth.

Minimum Deposit: $2,000

Target Return: Up to 25% per month

Risk Management: Moderate risk (1–2% per trade).

🔥 3. Aggressive Version

Maximizing market opportunities for higher returns.

Minimum Deposit: $3,000

Target Return: Up to 40% per month

Risk Management: Increased intensity (2–3% per trade).

💡 Key Details:

24/5 Automated Copy Trading (during market hours).

50/50 Profit Share — we only earn when you do.

You maintain full control over your funds.

✅ All tiers are now live and available!

💵if you want to get started with any of our trading systems simply drop our admin 👉 @kalnrozes a message saying ‘FOREX’ and we give you a start.

Not bad hey? in the current market cos this especially

💵if you want to get started with any of our trading systems simply drop our admin 👉 @kalnrozes a message saying ‘FOREX’ and we give you a start.

Taking advantage of the market